step 3. Home-equity personal line of credit

A house-collateral line of credit (otherwise HELOC) also provides a relatively lowest-cost borrowing from the bank option with lots of self-reliance in terms so you’re able to family renovations. Its secure by your family. If you’re not capable repay it, this new loan company can be foreclose.

“As homeowners are accumulating collateral quicker, a house equity personal line of credit allows him or her borrow against the brand new offered security home up to their borrowing limit,” Terango claims. “Additionally, home-collateral credit lines promote residents the flexibility out-of good rotating personal line of credit and this can be utilized as required, therefore can render more desirable interest levels than other money options which will save money eventually.”

The way it works: A property collateral personal line of credit really works similarly to good rotating personal line of credit such as a charge card. You will find an optimum amount you could borrow, and you also build payments that have desire. Lenders fundamentally wouldn’t accept you for over 85% of the house’s worth, without having the matter you owe on the mortgage.

Your own credit limit will additionally depend on exactly how much you are ready in order to qualify for. In the event the, eg, the quantity which are often lent up against your home is $140,one hundred thousand, but your money and you can credit rating don’t be considered you regarding count, the newest restrict might be lower.

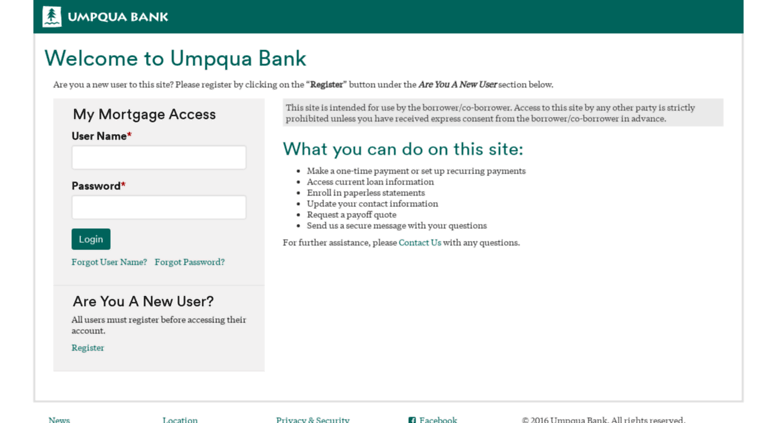

Money from a great HELOC would be reduced to the new company in the way of a check or debit deal.

Quick tip: Be sure to shop around having a good HELOC. Because it’s a mortgage equipment, you’ll be able to come across different rates and closing costs. Shopping around makes it possible to get the best price small personal loans Tulsa and lower settlement costs.

Whether or not it makes sense: In the event the home has a lot of collateral and if you are being unsure of out of what your remodeling prices are probably going to be

4. Home-guarantee financing

A home-collateral mortgage feels like good HELOC where your home is put as the equity into the financing. However, that have a property-collateral loan, the complete matter was borrowed up front, and repayments start now. The interest cost is actually reduced and you can finance shall be spreading on the homeowner’s discernment.

The quantity that you could use hinges on your income, credit file, and market value of your property, however, essentially employs an identical advice due to the fact a good HELOC. The main improvement try a homeowner borrows a predetermined amount that have a fixed interest rate towards a home-equity financing. There will also be even more can cost you.

“Borrowers need to keep planned when borrowing from the bank against your property is that its home financing purchase,” George says. “Which will leads to some kind of closing costs that can mean several thousand dollars.”

Note: The degree of attention you have to pay towards the a property security financing otherwise HELOC are taxation-allowable. This is not correct to many other types of credit, particularly a property-improve financing, unsecured loan, or mastercard.

5. Cash-aside refinancing

For those who have an abundance of equity of your property, you can make use of a money-aside refinancing to displace your own dated home loan with a brand new you to and have the difference in your bank account. Having a cash-aside refinancing, you are taking out financing larger than the total amount you still owe and you will receive a portion of your own house’s gathered well worth for the bucks.

It is another financial, therefore you’ll be considered centered on earnings and you can credit rating. A finances-out refinancing generally provides an optimum financing-to-value (LTV) proportion of 80%, definition, you might only cash-out to 80% of your house’s value.

Particularly, for folks who are obligated to pay $200,100 in your house and it’s really worthy of $350,one hundred thousand, you could potentially refinance around 80% regarding $350,one hundred thousand, which is $280,100. The fresh new $200,100 home loan was paid and you’re remaining that have $80,100000 within the cash.