What are things on home financing and you will precisely what do they mean for your requirements while the a homebuyer? This can be a concern that lots of people have whenever planning to invest in a house. Financial situations, known as to buy along the rates, is actually charge that you shell out on the home loan company managed to obtain a lowered interest on your own mortgage.

Mortgage products is essentially prepaid interest that give the consumer good straight down rate of interest on their home loan. The amount of points that consumers spend may differ predicated on the credit rating, the type of financing they choose or other facts. Circumstances are regarded as an upfront money that enables the latest borrower to save money finally.

What are home loan items?

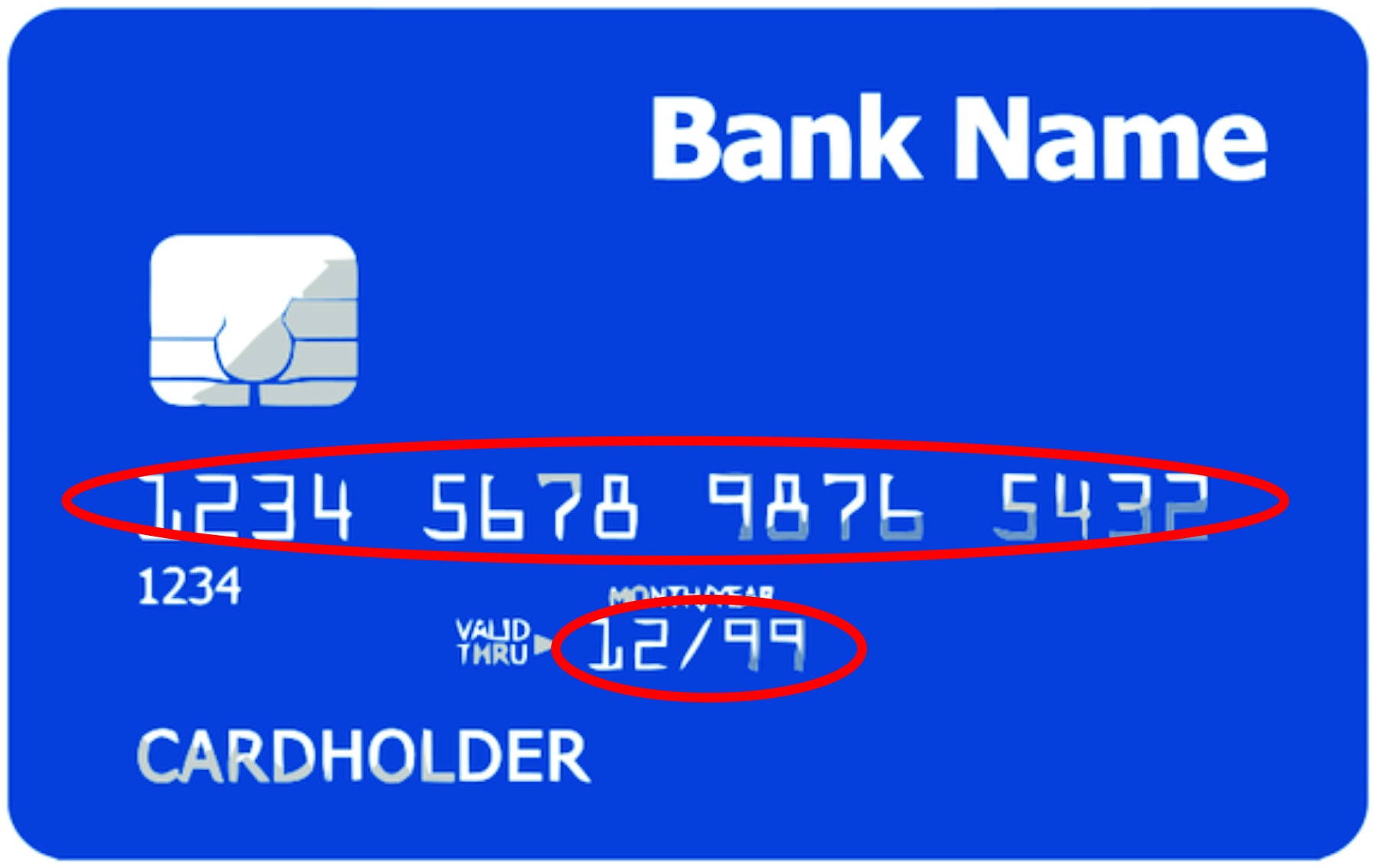

Mortgage factors are charges paid down to lower the pace towards the a mortgage loan. For every single section will cost you 1% of your own full loan amount. Instance, towards a good $five hundred,000 loan, some point would cost $5,000.

Financial affairs are known as write off facts or get-down things. Some lenders provide money no products, while some need new borrower to expend two to three factors to reach a particular home loan speed. Investing products normally reduce steadily the month-to-month mortgage payment and you will save you money along the longevity of the mortgage.

Yet not, it is vital to estimate perhaps the initial price of points was really worth the long-name coupons. Consumers should also contrast pricing out of numerous loan providers to find the best deal. Good principle, getting a 30-year repaired-rates mortgage, for each and every write off part you have to pay will bring you a great 0.125% so you can 0.25% rates cures in your home loan.

paydayloancolorado.net/inverness

If you choose to pick off the price, the amount you will spend to take action could be itemized as well as various other closing costs on financing imagine considering by your financial.

Home loan Factors Analogy – $600,000 Loan

- Cost: $900,100

- Advance payment: $300,100000

- Loan amount: $600,100

- Mortgage facts: dos things

- Facts cost in the closure: $twelve,000

- Mortgage repayment (30-season, 5%): $3,

- Rates cures: 0.50% (0.25% for every part)

- Mortgage payment (30-12 months, cuatro.5%): $step 3,

- Monthly coupons: $

The level of issues you pay to the a mortgage is influenced by numerous situations, such as the rate of interest, the mortgage number, and the amount of the loan.

To help you determine brand new items you will have to shell out, you’ll be able to basic need certainly to examine the attention rates of various money.The rate ‘s the portion of the borrowed funds which you can need to pay back to addition to your dominant. The higher the interest rate, more products you will have to spend.

You will need to check out the loan amount whenever figuring things. The greater the loan, the greater affairs you’ll need to pay.

Fundamentally, you’ll want to check out the period of the loan. The new longer the borrowed funds, the greater number of activities you’ll want to shell out. By the provided each one of these items, you could potentially calculate just how many factors you will need to spend to the their real estate loan.

Whenever is the better time and energy to spend home loan circumstances?

If you are planning on the staying in your house for a long date, it could seem sensible to pay things beforehand appreciate the lower monthly payments. Simultaneously, if you were to think there is a go you may promote your home in the near future, it could be far better ignore purchasing issues because the initial costs would be greater than the total deals.

Whenever financial pricing is lower, of numerous consumers leave the cost of points. Yet not, whenever financial rates is large otherwise quickly growing, homeowners will consider the alternative because a trick to attain a lowered home loan speed.

Are there any income tax advantages of spending mortgage factors?

Home loan things is also generally become deducted due to the fact attract in your federal fees, as long as you satisfy specific criteria. In order to grab the deduction, you need to itemize the deductions with the Agenda An excellent of your income tax go back, additionally the situations have to have become paid in buy discover the loan. On the other hand, the borrowed funds can be used to find or improve your number one home.

For those who meet most of these requirements, you can subtract an entire level of mortgage activities paid-in the season they certainly were repaid. Instance, for folks who paid down $6,000 when you look at the affairs to the a great $600,100000 financing within the 2020, you can subtract the entire matter on your 2020 tax go back. Investing mortgage issues provide beneficial income tax discounts for people who learn the way the deduction works just in case your satisfy the qualifications standards.

Do you know the threats with the spending home loan things?

When you are paying situations will get save some costs across the life of the loan, there are also particular risks to look at.

First, you will need to afford the factors even if you sell the property or re-finance the loan inside a few years, so they really is good sunk rates. Second, if the rates of interest slide once you intimate on your loan, you may be trapped which have a higher rate than simply for people who hadn’t paid down issues.

As with any financial decision, you should weighing the dangers and you may advantages of paying financial situations prior to a partnership.

Just how can an effective homebuyer obtain the most really worth with financial items?

Purchasing circumstances shall be the best way to spend less on focus along side lifetime of the mortgage, however it is crucial that you assess in the event it helps make monetary feel inside each person circumstances.

Homeowners would be to evaluate the interest rate that have and you may instead of items to observe long it can test recover the expense of the things. They must contemplate their plans into possessions once they greet promoting it in the future, they could perhaps not stay in your house long enough to benefit throughout the down interest.

At some point, whether to buy mortgage points is a decision that is produced based on each homebuyer’s novel activities.