As well as the particular financing you sign up for, think about the information on the loan

- Gizmos lease. Maybe not in place of leasing an automible, gizmos rentals dispersed the price of a major devices purchase more than a-flat period of time. Very lessors do not require a large downpayment with the a lease, as soon as new lease has actually manage the path, you can opt to often come back the device otherwise pay the other countries in the equipment’s well worth according to research by the life of this new lease while the appreciate of one’s item concerned. Although monthly installments is below the fresh new initial pricing of merely to order a piece of gadgets, it is essential to keep in mind that appeal will add into speed level.

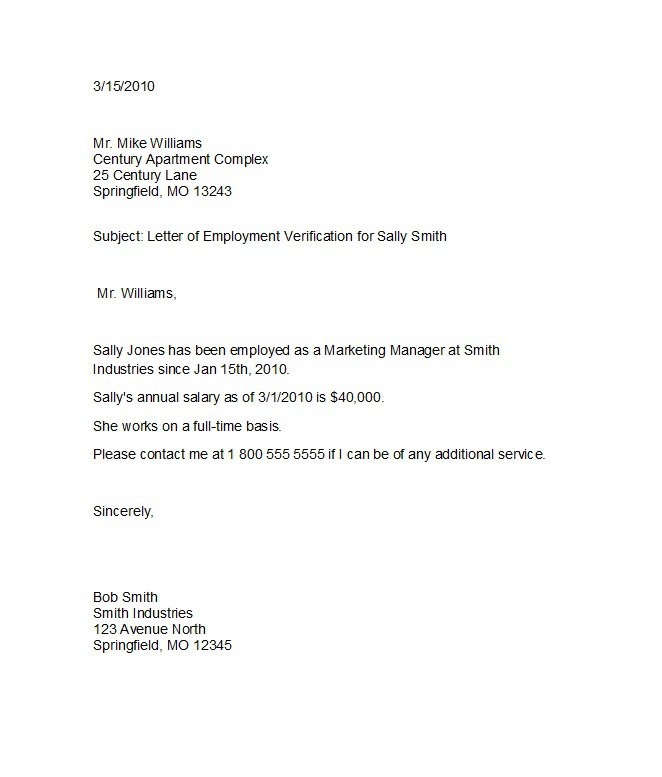

- Page off borrowing. A letter off credit is actually a promise out of a bank one to a seller get a correct commission owed timely. The new make certain is available in several different tastes: seller coverage otherwise consumer shelter. In the previous, the financial institution believes to pay the seller in the event your client fails and work out the money that is generally considering to possess internationally purchases. Funds for it style of page are occasionally gathered in the consumer initial when you look at the a sort of escrow. Visitors defense is out there in the way of a punishment so you’re able to the vendor, such as a reimbursement. Financial institutions promote these types of emails in order to companies that apply for you to definitely and you can feel the credit score otherwise guarantee necessary.

- Unsecured team mortgage. An unsecured organization loan has no need for this new debtor to incorporate any collateral up against the count they truly are borrowing. While the it’s friendlier toward borrower than the lender, the financial institution costs a dramatically highest interest rate than just it can for a financial loan supported by collateral. This sort of mortgage was most commonly offered thanks to an online financial or any other option loan providers, whether or not conventional financial institutions had been known to render personal loans in order to consumers that have a current reference to the institution. Without having any assurances in the way of guarantee, unsecured loans are often more complicated discover than many other money. The fresh new inherent risk employed in loans South Vinemont a personal bank loan naturally setting they will normally be provided given that a primary-label loan to ease the fresh new lender’s risk.

Selection in order to loans from banks

Loans are not their sole option. You can run option loan providers so you can hold the investment you you would like. Alternative lenders was a solution to consider when your organization will not qualify for a vintage mortgage. Here are a few alternative lending products to take on:

As well as the sort of financing your sign up for, look at the details of the borrowed funds

- On the web financing: On line lenders are typically significantly more versatile with mortgage certification, and the recovery big date are quicker, nevertheless the prices is higher than conventional financing. Lendio is the one such as for example online bank. You could potentially fill out an application compliment of their safer program.

- Microloans:Microloans promote a small amount of currency to help you protection particular can cost you inside your business. Microloans will often have a fairly low-value interest. The newest downsides out of microloans are a shorter time frame to invest right back the loan, and some loan providers need that funds from this new microloan be spent on specific expenditures such as gizmos requests.

For every financing has its own interest rate and financing title, certainly one of most other factors out-of planning that will be as the incredibly important as the the kind of mortgage you are taking into. It is vital to investigate bargain completely to be sure around aren’t hidden words or charge.

Rates: As well as the amount of money you need to borrow, the borrowed funds rates otherwise known as the speed is a thing you surely need to determine. Mortgage pricing differ according to the style of loan you may be seeking, the financial institution you may be borrowing the funds from as well as your private borrowing from the bank rating, among other things. When looking for a business financing, need one to having a low-value interest, whenever possible. According to type of mortgage, you’ll be able to see prices range between step three% up to 80% annual percentage rate.